Impact of Global Events on Cryptocurrency Trends

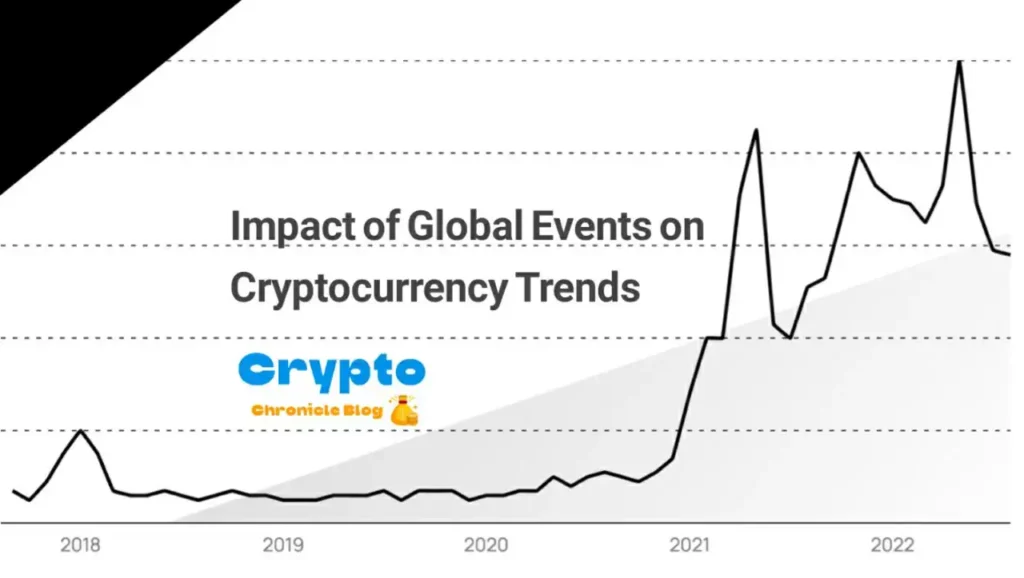

In the dynamic world of cryptocurrencies, global events play a significant role in shaping market trends and investor sentiment. From geopolitical tensions to economic indicators, various factors influence the behavior of cryptocurrency prices and market dynamics. In this professional article, we delve into the intricate relationship between global events and cryptocurrency trends, analyzing their impact on market movements and investor behavior.

Understanding the Interconnection

Cryptocurrency markets are intricately interconnected with global events, responding to both macroeconomic developments and geopolitical tensions. Events such as central bank announcements, regulatory decisions, and geopolitical crises can trigger significant fluctuations in cryptocurrency prices and trading volumes.

Economic Indicators and Monetary Policy

Economic indicators, such as inflation rates, GDP growth, and unemployment figures, can have a profound impact on cryptocurrency markets. Monetary policy decisions by central banks, including interest rate changes and quantitative easing measures, also influence investor sentiment and market trends.

Geopolitical Tensions and Market Volatility

Geopolitical tensions and geopolitical events often lead to increased market volatility in the cryptocurrency space. Factors such as trade disputes, international conflicts, and political instability can drive investors towards safe-haven assets like Bitcoin, resulting in price surges during times of uncertainty.

Regulatory Developments and Investor Confidence

Regulatory developments and government policies have a significant impact on cryptocurrency markets, influencing investor confidence and market sentiment. Positive regulatory announcements, such as the approval of cryptocurrency ETFs or the introduction of favorable regulatory frameworks, can boost investor confidence and drive market adoption.

Technological Innovations and Market Evolution

Technological innovations and advancements in blockchain technology also shape cryptocurrency trends. Developments such as scalability solutions, interoperability protocols, and decentralized finance (DeFi) platforms influence market dynamics and investor behavior, driving adoption and innovation within the cryptocurrency ecosystem.

Analyzing Market Reactions

Analyzing market reactions to global events requires a multidimensional approach, combining technical analysis, fundamental analysis, and sentiment analysis. Traders and investors utilize various tools and indicators to gauge market sentiment and identify potential trading opportunities amid changing market conditions.

Case Studies and Real-world Examples

Examining case studies and real-world examples can provide valuable insights into the relationship between global events and cryptocurrency trends. Analyzing past market reactions to events such as economic crises, regulatory announcements, and technological developments helps to understand patterns and trends in cryptocurrency markets.

Conclusion: Navigating Market Dynamics

In conclusion, global events have a profound impact on cryptocurrency trends, influencing market movements and investor behavior. Understanding the interconnection between global events and cryptocurrency markets is essential for traders, investors, and market participants to navigate market dynamics and make informed decisions in the ever-changing landscape of cryptocurrency markets.

By analyzing the effects of global events on cryptocurrency trends, market participants can better anticipate market movements, manage risks, and capitalize on opportunities in the dynamic and rapidly evolving cryptocurrency ecosystem.

Frequently Asked Questions – Question and Answer

Q: What are the main factors influencing cryptocurrency prices?

A: Cryptocurrency prices are influenced by various factors, including supply and demand dynamics, market sentiment, regulatory developments, technological advancements, and macroeconomic trends.

Q: How can I mitigate risks when investing in cryptocurrencies?

A: To mitigate risks when investing in cryptocurrencies, consider diversifying your investment portfolio, conducting thorough research before investing, staying updated on market trends and developments, and only investing what you can afford to lose.

Q: Are cryptocurrencies legal in all countries?

A: The legal status of cryptocurrencies varies from country to country. While some countries have embraced cryptocurrencies and enacted supportive regulations, others have imposed restrictions or outright bans on their use and trading.

Q: What is the difference between cryptocurrencies and traditional fiat currencies?

A: Cryptocurrencies are digital or virtual currencies that utilize cryptography for security and operate on decentralized networks, such as blockchain. Traditional fiat currencies, on the other hand, are issued and regulated by governments and central banks and are typically physical forms of money, such as banknotes and coins.

Q: How do I store my cryptocurrencies safely?

A: Cryptocurrencies can be stored in various types of wallets, including hardware wallets, software wallets, and paper wallets. It’s essential to choose a reputable wallet provider, enable two-factor authentication, and keep your private keys secure to ensure the safety of your digital assets.

Q: Can I use cryptocurrencies for everyday transactions? A: While the use of cryptocurrencies for everyday transactions is becoming more widespread, adoption varies by region and industry. Some merchants and businesses accept cryptocurrencies as payment, but widespread adoption as a medium of exchange is still limited compared to traditional fiat currencies.

Q: What is the future outlook for cryptocurrencies? A: The future outlook for cryptocurrencies is subject to speculation and uncertainty, but many experts believe that cryptocurrencies will continue to play a significant role in the future of finance and technology. Factors such as regulatory developments, technological advancements, and market adoption will likely influence the trajectory of the cryptocurrency market in the coming years.